Ever since I received my Spanish residency card back in August 2022 (see main picture), I’ve tried my best to scrape a living as a translator. A few weeks ago, however, I lost my most important client and it meant I could no longer afford to stay in business. This is because even if I don’t earn anything in a month – which has been the case in June and July – the Spanish government will continue to take my social security payment out of my account every month. This figure is currently 255.97 euros and is based on my previous year’s average monthly earnings. Since I have no work on the horizon, I have had no alternative but to deregister with the tax office to avoid any further payments leaving my account. Sadly it means I will no longer be able to work. I always thought it would be AI that hammered the final nail into my coffin – they’ve hammered all the other ones in – but it seems the Spanish government and their backward tax system has jumped in and done it for them.

For anyone who is unaware of social security payments in Spain, I have added a screenshot below which illustrates the contributions self-employed people have to make. I should also mention that during the first two years in business, there is a grace period where you only have to pay 60 euros a month. I found this quite reasonable considering the small amount I was earning. In the third year, however, figures were based on the previous year’s monthly average. This is where I began to really struggle because paym,ents shot up but my earnings hadn’t improved. Incredibly, payments start as high as 205 euros per month for anyone who earns anything from zero up to 670 euros per month. My monthly income, based on the previous year, was only 850 euros a month yet, due to the Spanish taxation system, I’ve had to pay a quota of 255 euros every month – a very large sum of money considering how little I was earning. As already mentioned, I’m now earning zero but the money would have continued to be debited from my account had I not deregistered with them.

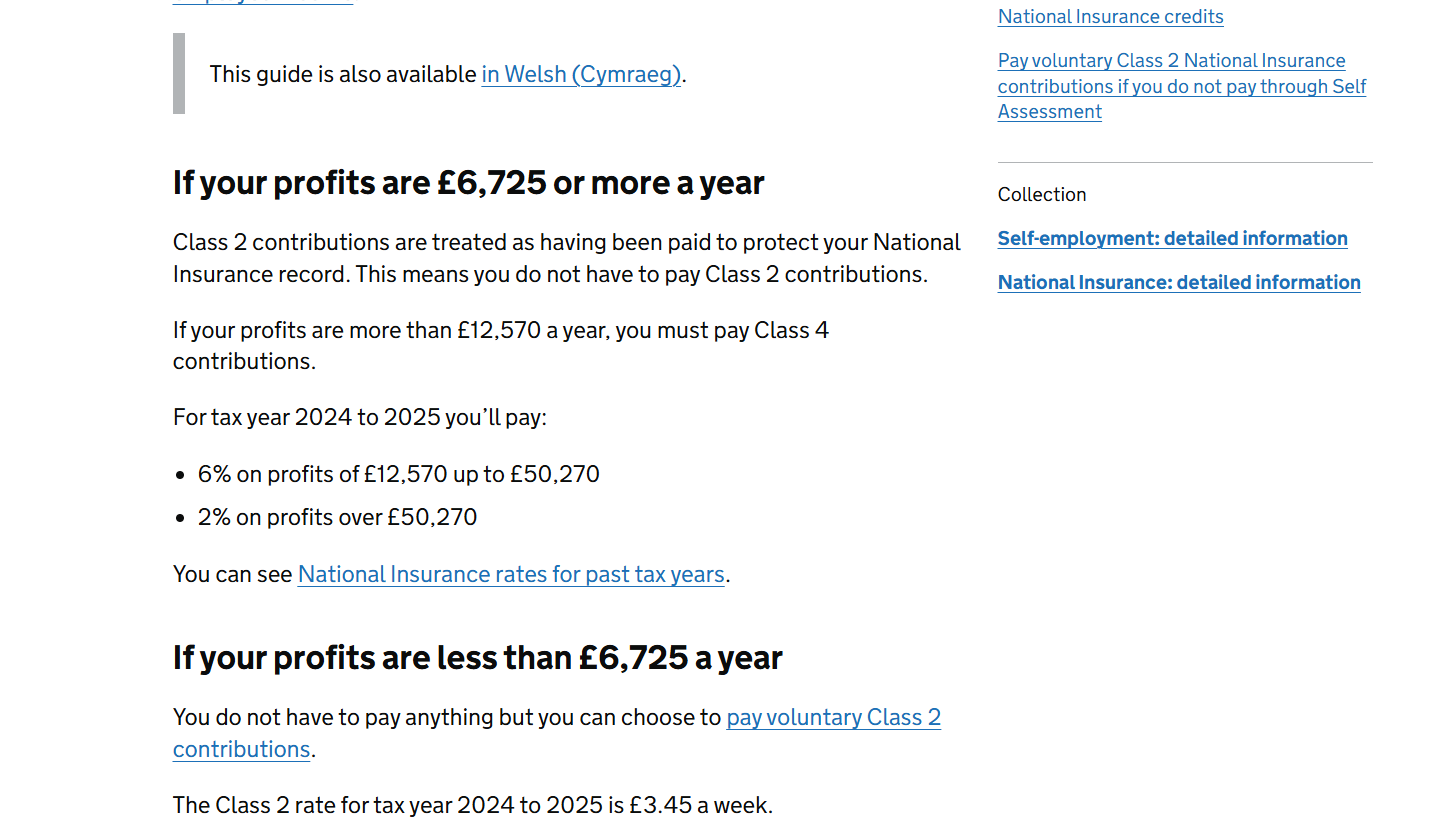

A week or so ago, when I deregistered, I took some time to look into the British equivalent of social security which is called National Insurance. I’ve added a second screenshot below, which shows that for self-employed people, discounting any voluntary contributions, National Insurance is not paid until you have earned over £12570 in the year at which point you have to start paying 6% on any earnings over that amount. This £12570 as a monthly average works out at £1047.50 and converted to euros gives you 1208.92 euros. So in the UK, this figure represents the highest your monthly earnings could be before you have to start paying any social security/National Insurance contributions. Now, if you compare this to the Spanish model, taking the very similar figure of 1209.15 euros a month, you can see the quota is a staggering 380 euros – about a third of what you earn! And all of this is before even thinking about Spanish income tax (IRPF) which is also much higher than the UK. However, this article only concentrates on social security contributions as my income tax payments were inconsequential by comparison.

What has really rubbed salt into the wounds for me is that if I had been working in the UK and earning the same paltry wage as I have been in Spain these last few years, I would not have been liable to pay a single penny in social security payments. The system here in Spain is incredibly unfair and totally unsustainable for people on lower wages. Having said that, it is also far from ideal for high earners. Looking at the highest end of scale, if your net income is between 4050 and 6000 euros a month, you have to pay a minimum of 544 euros in social security contributions – although if you wanted you could pay upto 1542 for a higher contribution base – whereas in the UK the person at the top end of the 6% bracket who earns £50270, which is the equivalent of 4850.76 euros per month, would only be paying £188.50 or 218 euros a month. It is a big difference and it is little wonder so many people – both low and high earners – participate in tax avoidance in Spain. Of course, the benefit of paying higher social security contributions is that when you retire, the Spanish state pension is more generous than the UK state pension. However, in the UK many earners who are better off will take out a private pension to boost what they receive from their state pension. In the UK, therefore, there is a choice available when it comes to your pension contributions, whereas in Spain the state makes that choice for you – even when you can’t afford it.

Ideally, what I would like to do now is register as self-employed in the UK and start paying my taxes there. However, this is going to be difficult for me since I live most of the year in Spain. I have looked into how I can be classed as a UK resident. There are four main tests. The most obvious one is if I live at least 183 days a year in the UK. This is something I am willing to consider doing if it means I can avoid being robbed blind by the Spanish government. Although my career as a translator may be coming to an end, it would still be nice to be available to pick up any jobs that are offered to me in the future. This would be possible if I am registered in the UK as, unlike in Spain, they wouldn’t be extracting significant amounts of money from my account if I was earning next to nothing. More importantly, however, I expect to be publishing my first book before the end of this year and I would prefer any profits to go through the UK tax system rather than Spain’s.

For now, at least I know where I am and I can really concentrate on having my book ready by the end of the year. Although it’s sad to think my translation career didn’t work out, it’s also a blessed relief that I can now move on. With the translation industry in disarray thanks to rapid advances in Artificial Intelligence, and the Spanish Government helping themselves to a large part of my scant earnings, it has often felt as though higher powers have been conspiring against me. Never mind though, I’m pleased the torture is finally over and I can put my heart and soul into something else.

One final thing, I’m no expert when it comes to matters of Spanish or UK tax, so if I have misinterpreted any information, I apologise in advance.

Leave a reply to The Travel Architect Cancel reply